Arbeitspapier

Cross- and Auto-Correlation Effects arising from Averaging: The Case of US Interest Rates and Equity Duration

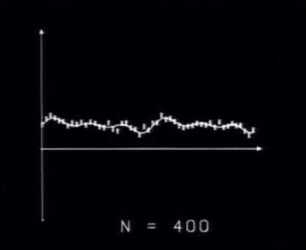

Most of the available monthly interest data series consist of monthlyaverages of daily observations. It is well-known that this averaging introduces spurious autocorrelation effectsin the first differences of the series. It isexactly this differenced series we are interested in when estimatinginterest rate risk exposures e.g. This paperpresents a method to filter this autocorrelation component from theaveraged series. In addition we investigate thepotential effect of averaging on duration analysis, viz. whenestimating the relationship between interest rates andfinancial market variables like equity or bond prices. In contrast tointerest rates the latter price series are readilyavailable in ultimo month form. We find that combining monthlyreturns on market variables with changes inaveraged interest rates leads to serious biases in estimatedcorrelations (R2s), regression coefficients (durations)and their significance (t-statistics). Our theoretical findings areconfirmed by an empirical investigation of USinterest rates and their relationship with US equities (S&P 500Index).

- Language

-

Englisch

- Bibliographic citation

-

Series: Tinbergen Institute Discussion Paper ; No. 00-064/2

- Classification

-

Wirtschaft

Estimation: General

Single Equation Models; Single Variables: Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes

Methodology for Collecting, Estimating, and Organizing Macroeconomic Data; Data Access

Interest Rates: Determination, Term Structure, and Effects

General Financial Markets: General (includes Measurement and Data)

- Subject

-

interest rates

duration

averaging

time series properties

spurious autocorrelation

Zins

Zeitreihenanalyse

Schätztheorie

Theorie

Korrelation

Autokorrelation

- Event

-

Geistige Schöpfung

- (who)

-

Hallerbach, Winfried G.

- Event

-

Veröffentlichung

- (who)

-

Tinbergen Institute

- (where)

-

Amsterdam and Rotterdam

- (when)

-

2000

- Handle

- Last update

-

10.03.2025, 11:44 AM CET

Data provider

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. If you have any questions about the object, please contact the data provider.

Object type

- Arbeitspapier

Associated

- Hallerbach, Winfried G.

- Tinbergen Institute

Time of origin

- 2000