Arbeitspapier

Money velocity in an endogenous growth business cycle with credit shocks

The paper sets the neoclassical monetary business cycle model within endogenous growth, adds exchange credit shocks, and finds that money and credit shocks explain much of the velocity variation. The role of the shocks varies across sub-periods in an intuitive fashion. Endogenous growth is key to the construction of the money and credit shocks since these have similar effects on velocity, but opposite effects upon growth. The model matches the data's average velocity and simulates well velocity volatility. Its Cagan-like money demand means that money and credit shocks cause greater velocity variation the higher is the nominal interest rate.

- Language

-

Englisch

- Bibliographic citation

-

Series: MNB Working Papers ; No. 2007/5

- Classification

-

Wirtschaft

General Aggregative Models: Neoclassical

Business Fluctuations; Cycles

Financial Markets and the Macroeconomy

- Subject

-

velocity

business cycle

credit shocks

endogenous growth

Geldumlaufgeschwindigkeit

Neue Wachstumstheorie

Konjunktur

Schock

Theorie

- Event

-

Geistige Schöpfung

- (who)

-

Benk, Szilárd

Gillman, Max

Kejak, Michal

- Event

-

Veröffentlichung

- (who)

-

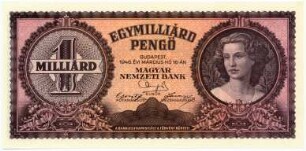

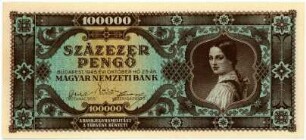

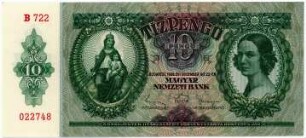

Magyar Nemzeti Bank

- (where)

-

Budapest

- (when)

-

2007

- Handle

- Last update

-

10.03.2025, 11:42 AM CET

Data provider

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. If you have any questions about the object, please contact the data provider.

Object type

- Arbeitspapier

Associated

- Benk, Szilárd

- Gillman, Max

- Kejak, Michal

- Magyar Nemzeti Bank

Time of origin

- 2007