Arbeitspapier

Interest limitation rules and business cycles: Empirical evidence

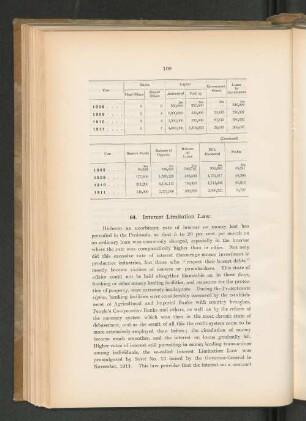

This paper studies the performance of interest limita- tion rules during business cycles. It employs register data on Finnish affiliates of multinational enterprises (MNEs) to study both thin-capitalization rules (TCRs) and earnings-stripping rules (ESRs). Both types of rules are found to become tighter in economic downturns: TCRs due to higher debt-to-equity ratios and ESRs due to lower company profits. Among equally tight interest limitation rules, TCRs are found to provide less variation and less pro-cyclical outcomes by increasing the compa- ny tax burden less than ESRs in an economic downturn. While ESRs increase the tax burden of Finnish compa- nies by 17.5%-19.3% following the 2008 global financial crisis, for TCRs the increase is less than 10%. Among the ESRs, we find that an EBIT rule induces tighter tax treat- ment in economic downturns than an EBITDA rule. How- ever, the differences between ESRs remain very small.

- Language

-

Englisch

- Bibliographic citation

-

Series: ETLA Working Papers ; No. 90

- Classification

-

Wirtschaft

Business Taxes and Subsidies including sales and value-added (VAT)

Tax Evasion and Avoidance

International Business Cycles

- Subject

-

Business cycles

Corporate income taxation

Anti-tax avoidance rules

Thin-Capitalization Rules (TCRs)

Earnings Stripping Rules (ESRs)

- Event

-

Geistige Schöpfung

- (who)

-

Ropponen, Olli

- Event

-

Veröffentlichung

- (who)

-

The Research Institute of the Finnish Economy (ETLA)

- (where)

-

Helsinki

- (when)

-

2021

- Handle

- Last update

-

10.03.2025, 11:42 AM CET

Data provider

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. If you have any questions about the object, please contact the data provider.

Object type

- Arbeitspapier

Associated

- Ropponen, Olli

- The Research Institute of the Finnish Economy (ETLA)

Time of origin

- 2021