Artikel

Interest limitation rule under ATAD: Case of the Czech Republi

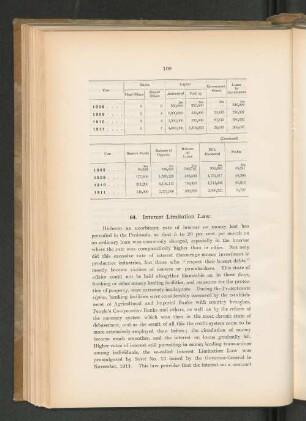

The anti-tax avoidance directive (ATAD) implemented in the EU countries in 2019 has brought, among other things, a common rule for tax-deductibility of exceeding borrowing costs of corporate taxpayers - the interest limitation rule. For interest limitation, the Czech Republic had so far used the so-called safe haven thin capitalisation rule. With the implementation of ATAD, companies need to test not only the thin capitalisation rule but also the new interest limitation rule according to ATAD. This paper aims to review the impact of the new interest limitation rule on the 200 largest Czech companies by their 2017 revenue as recorded in the Albertina database. Results covering the new rules, i.e. following the ATAD implementation, are being compared to the situation before the implementation. Most of the analysed companies seem unaffected by the new interest limitation rule. The analysis also showed that most of the analysed companies do not imply exceeding borrowing costs, either before or following the ATAD implementation.

- Sprache

-

Englisch

- Erschienen in

-

Journal: DANUBE: Law, Economics and Social Issues Review ; ISSN: 1804-8285 ; Volume: 12 ; Year: 2021 ; Issue: 2 ; Pages: 121-134 ; Warsaw: De Gruyter

- Klassifikation

-

Wirtschaft

- Thema

-

ATAD

BEPS

Thin Capitalisation Rule

Interest Limitation Rule

- Ereignis

-

Geistige Schöpfung

- (wer)

-

Pivoňková, Aneta

Tepperová, Jana

- Ereignis

-

Veröffentlichung

- (wer)

-

De Gruyter

- (wo)

-

Warsaw

- (wann)

-

2021

- DOI

-

doi:10.2478/danb-2021-0009

- Handle

- Letzte Aktualisierung

-

10.03.2025, 11:44 MEZ

Datenpartner

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. Bei Fragen zum Objekt wenden Sie sich bitte an den Datenpartner.

Objekttyp

- Artikel

Beteiligte

- Pivoňková, Aneta

- Tepperová, Jana

- De Gruyter

Entstanden

- 2021