Artikel

Volterra equation for pricing and hedging in a regime switching market

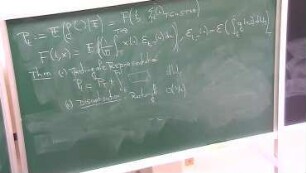

It is known that the risk minimizing price of European options in Markovmodulated market satisfies a system of coupled PDE, known as generalized B-S-M PDE. In this paper, another system of equations, which can be categorized as a Volterra integral equations of second kind, are considered. It is shown that this system of integral equations has smooth solution and the solution solves the generalized B-S-M PDE. Apart from showing existence and uniqueness of the PDE, this IE representation helps to develop a new computational method. It enables to compute the European option price and corresponding optimal hedging strategy by using quadrature method.

- Sprache

-

Englisch

- Erschienen in

-

Journal: Cogent Economics & Finance ; ISSN: 2332-2039 ; Volume: 2 ; Year: 2014 ; Issue: 1 ; Pages: 1-11 ; Abingdon: Taylor & Francis

- Klassifikation

-

Wirtschaft

- Thema

-

Markov modulated market

locally risk minimizing option price

Black-Scholes-Merton equations

Volterra equation

quadrature method

- Ereignis

-

Geistige Schöpfung

- (wer)

-

Goswami, Anindya

Saini, Ravi Kant

- Ereignis

-

Veröffentlichung

- (wer)

-

Taylor & Francis

- (wo)

-

Abingdon

- (wann)

-

2014

- DOI

-

doi:10.1080/23322039.2014.939769

- Handle

- Letzte Aktualisierung

-

10.03.2025, 11:44 MEZ

Datenpartner

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. Bei Fragen zum Objekt wenden Sie sich bitte an den Datenpartner.

Objekttyp

- Artikel

Beteiligte

- Goswami, Anindya

- Saini, Ravi Kant

- Taylor & Francis

Entstanden

- 2014