Arbeitspapier

Sweet Lemons: Mitigating Collusion in Organizations

This paper shows that the possibility of collusion between an agent and a supervisor imposes no restrictions on the set of implementable social choice functions (SCF) and associated payoff vectors. Any SCF and any payoff profile that are implementable if the supervisor′s information was public is also implementable when this information is private and collusion is possible. To implement a given SCF we propose a one-sided mechanism that endogenously creates private information for the supervisor vis-à-vis the agent, and conditions both players′ payoffs on this endogenous information. We show that in such a mechanism all collusive side-bargaining fails, similar to the trade failure in Akerlof′s (1970) car market and in models of bilateral trade.

- Sprache

-

Englisch

- Erschienen in

-

Series: Discussion Paper ; No. 100

- Klassifikation

-

Wirtschaft

Asymmetric and Private Information; Mechanism Design

Search; Learning; Information and Knowledge; Communication; Belief; Unawareness

Economics of Regulation

- Thema

-

mechanism design

collusion

asymmetric information

correlation

- Ereignis

-

Geistige Schöpfung

- (wer)

-

Pollrich, Martin

von Negenborn, Colin

- Ereignis

-

Veröffentlichung

- (wer)

-

Ludwig-Maximilians-Universität München und Humboldt-Universität zu Berlin, Collaborative Research Center Transregio 190 - Rationality and Competition

- (wo)

-

München und Berlin

- (wann)

-

2018

- Handle

- Letzte Aktualisierung

-

10.03.2025, 11:42 MEZ

Datenpartner

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. Bei Fragen zum Objekt wenden Sie sich bitte an den Datenpartner.

Objekttyp

- Arbeitspapier

Beteiligte

- Pollrich, Martin

- von Negenborn, Colin

- Ludwig-Maximilians-Universität München und Humboldt-Universität zu Berlin, Collaborative Research Center Transregio 190 - Rationality and Competition

Entstanden

- 2018

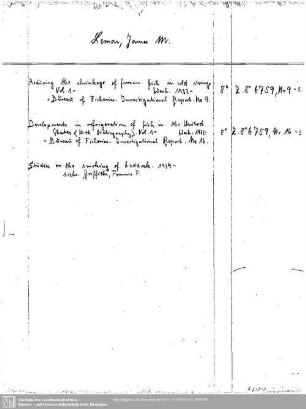

![Margareta Lemon [Porträt der Geliebten von A. vand Dyck, Margaret Lemon; Margaret Lemon; Portret van Margaret Lemon]](https://iiif.deutsche-digitale-bibliothek.de/image/2/0ddc5315-ba5b-49a4-bff0-c558a946cd0b/full/!306,450/0/default.jpg)