Arbeitspapier

Interest rate rules, rigidities and inflation risks in a macro-finance model

Long-term bond yields contain a risk-premium, an important part of which is compensation for inflation risks. The substantial increase in the Fed funds rate in the mid-2000s did not raise long-term US Treasury yields due to the reduction in the term premium (so-called Greenspan conundrum) which was typically thought to be exogenous for monetary policy. We show using a New Keynesian macro-finance model that the term premium is endogenous and is greatly influenced by the specification of the Taylor rule. Finally, we extend the model with frictions (richer fiscal setup and wage rigidity) that are known to help jointly match macro and finance data and estimate the model on US data in 1961-2007 by the generalized methods of moments and simulated methods of moments.

- Language

-

Englisch

- Bibliographic citation

-

Series: MNB Working Papers ; No. 2021/2

- Classification

-

Wirtschaft

General Aggregative Models: Neoclassical

Price Level; Inflation; Deflation

Interest Rates: Determination, Term Structure, and Effects

Financial Markets and the Macroeconomy

- Subject

-

zero-coupon bond

nominal term premium

inflation risk

Taylor rule

New Keynesian

labor income taxation

wage rigidity

GMM

SMM

- Event

-

Geistige Schöpfung

- (who)

-

Horváth, Roman

Kaszab, Lorant

Mars, Ales

- Event

-

Veröffentlichung

- (who)

-

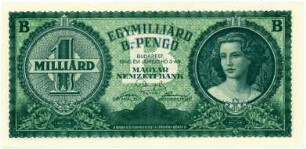

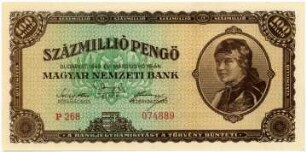

Magyar Nemzeti Bank

- (where)

-

Budapest

- (when)

-

2021

- Handle

- Last update

-

10.03.2025, 11:43 AM CET

Data provider

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. If you have any questions about the object, please contact the data provider.

Object type

- Arbeitspapier

Associated

- Horváth, Roman

- Kaszab, Lorant

- Mars, Ales

- Magyar Nemzeti Bank

Time of origin

- 2021