Arbeitspapier

Fiscal divergence and business cycle synchronization: Irresponsibility is idiosyncratic

Using a panel of 21 OECD countries and 40 years of annual data, we find that countries with similar government budget positions tend to have business cycles that fluctuate more closely. That is, fiscal convergence (in the form of persistently similar ratios of government surplus/deficit to GDP) is systematically associated with more synchronized business cycles. We also find evidence that reduced fiscal deficits increase business cycle synchronization. The Maastricht “convergence criteria,” used to determine eligibility for EMU, encouraged fiscal convergence and deficit reduction. They may thus have indirectly moved Europe closer to an optimum currency area, by reducing countries’ abilities to create idiosyncratic fiscal shocks. Our empirical results are economically and statistically significant, and robust.

- Sprache

-

Englisch

- Erschienen in

-

Series: MNB Working Papers ; No. 2005/3

- Klassifikation

-

Wirtschaft

International Policy Coordination and Transmission

- Thema

-

European

monetary

union

policy

Maastricht

criteria

optimum

Mundell

Konjunkturzusammenhang

Haushaltskonsolidierung

Finanzpolitik

Schätzung

OECD-Staaten

- Ereignis

-

Geistige Schöpfung

- (wer)

-

Darvas, Zsolt

Rose, Andrew K.

Szapáry, György

- Ereignis

-

Veröffentlichung

- (wer)

-

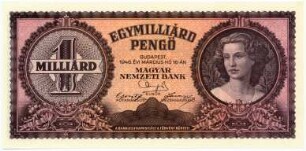

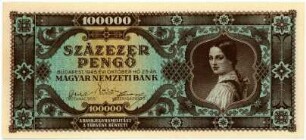

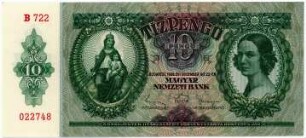

Magyar Nemzeti Bank

- (wo)

-

Budapest

- (wann)

-

2005

- Handle

- Letzte Aktualisierung

-

10.03.2025, 11:44 MEZ

Datenpartner

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. Bei Fragen zum Objekt wenden Sie sich bitte an den Datenpartner.

Objekttyp

- Arbeitspapier

Beteiligte

- Darvas, Zsolt

- Rose, Andrew K.

- Szapáry, György

- Magyar Nemzeti Bank

Entstanden

- 2005