Spectral methods for volatility derivatives

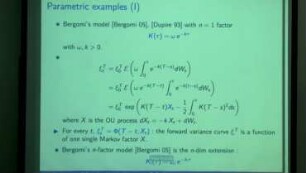

Abstract: In the first quarter of 2006 Chicago Board Options Exchange (CBOE) introduced, as one of the listed products, options on its implied volatility index (VIX). This created the challenge of developing a pricing framework that can simultaneously handle European options, forward-starts, options on the realized variance and options on the VIX. In this paper we propose a new approach to this problem using spectral methods. We use a regime switching model with jumps and local volatility defined in [1] and calibrate it to the European options on the S&P 500 for a broad range of strikes and maturities. The main idea of this paper is to “lift” (i.e. extend) the generator of the underlying process to keep track of the relevant path information, namely the realized variance. The lifted generator is too large a matrix to be diagonalized numerically. We overcome this difficulty by applying a new semi-analytic algorithm for block-diagonalization. This method enables us to evaluate numerically the

- Standort

-

Deutsche Nationalbibliothek Frankfurt am Main

- Umfang

-

Online-Ressource

- Sprache

-

Englisch

- Anmerkungen

-

Postprint

begutachtet (peer reviewed)

In: Quantitative Finance ; 9 (2009) 6 ; 663-692

- Klassifikation

-

Wirtschaft

- Ereignis

-

Veröffentlichung

- (wo)

-

Mannheim

- (wann)

-

2009

- Urheber

-

Mijatovic, Aleksandar

Albanese, Claudio

Lo, Harry

- DOI

-

10.1080/14697680902773603

- URN

-

urn:nbn:de:0168-ssoar-221488

- Rechteinformation

-

Open Access unbekannt; Open Access; Der Zugriff auf das Objekt ist unbeschränkt möglich.

- Letzte Aktualisierung

-

15.08.2025, 07:31 MESZ

Datenpartner

Deutsche Nationalbibliothek. Bei Fragen zum Objekt wenden Sie sich bitte an den Datenpartner.

Beteiligte

- Mijatovic, Aleksandar

- Albanese, Claudio

- Lo, Harry

Entstanden

- 2009