Artikel

An analysis and implementation of the hidden Markov model to technology stock prediction

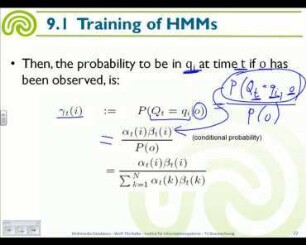

Future stock prices depend on many internal and external factors that are not easy to evaluate. In this paper, we use the Hidden Markov Model, (HMM), to predict a daily stock price of three active trading stocks: Apple, Google, and Facebook, based on their historical data. We first use the Akaike information criterion (AIC) and Bayesian information criterion (BIC) to choose the numbers of states from HMM.We then use the models to predict close prices of these three stocks using both single observation data and multiple observation data. Finally, we use the predictions as signals for trading these stocks. The criteria tests' results showed that HMM with two states worked the best among two, three and four states for the three stocks. Our results also demonstrate that the HMM outperformed the naïve method in forecasting stock prices. The results also showed that active traders using HMM got a higher return than using the naïve forecast for Facebook and Google stocks. The stock price prediction method has a significant impact on stock trading and derivative hedging.

- Sprache

-

Englisch

- Erschienen in

-

Journal: Risks ; ISSN: 2227-9091 ; Volume: 5 ; Year: 2017 ; Issue: 4 ; Pages: 1-16 ; Basel: MDPI

- Klassifikation

-

Wirtschaft

- Thema

-

hidden Markov model

stock prices

observations

states

predictions

AIC

BIC

likelihood

trading

- Ereignis

-

Geistige Schöpfung

- (wer)

-

Nguyen, Nguyet

- Ereignis

-

Veröffentlichung

- (wer)

-

MDPI

- (wo)

-

Basel

- (wann)

-

2017

- DOI

-

doi:10.3390/risks5040062

- Handle

- Letzte Aktualisierung

-

10.03.2025, 11:42 MEZ

Datenpartner

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. Bei Fragen zum Objekt wenden Sie sich bitte an den Datenpartner.

Objekttyp

- Artikel

Beteiligte

- Nguyen, Nguyet

- MDPI

Entstanden

- 2017