Arbeitspapier

House Prices, Expectations, and Time-Varying Fundamentals

We investigate the behavior of the equilibrium price-rent ratio for housing in a simple Lucas-type asset pricing model. We allow for time-varying risk aversion (via external habit formation) and time-varying persistence and volatility in the stochastic process for rent growth, consistent with U.S. data for the period 1960 to 2011. Under fully-rational expectations, the model significantly underpredicts the volatility of the U.S. price-rent ratio for reasonable levels of risk aversion. We demonstrate that the model can approximately match the volatility of the price-rent ratio in the data if near-rational agents continually update their estimates for the mean, persistence and volatility of fundamental rent growth using only recent data (i.e., the past 4 years), or if agents employ a simple moving-average forecast rule that places a large weight on the most recent observation. These two versions of the model can be distinguished by their predictions for the correlation between expected future returns on housing and the price-rent ratio. Only the moving-average model predicts a positive correlation such that agents tend to expect higher future returns when house prices are high relative to fundamentals-a feature that is consistent with survey evidence on the expectations of real-world housing investors.

- ISBN

-

978-82-7553-722-3

- Sprache

-

Englisch

- Erschienen in

-

Series: Working Paper ; No. 2013/05

- Klassifikation

-

Wirtschaft

Expectations; Speculations

Business Fluctuations; Cycles

Financial Markets and the Macroeconomy

Asset Pricing; Trading Volume; Bond Interest Rates

Economic Growth and Aggregate Productivity: General

Housing Supply and Markets

- Thema

-

asset pricing

excess volatility

housing bubbles

predictability

time-varying risk premiums

expected returns

- Ereignis

-

Geistige Schöpfung

- (wer)

-

Gelain, Paolo

Lansing, Kevin J.

- Ereignis

-

Veröffentlichung

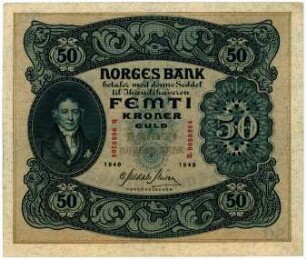

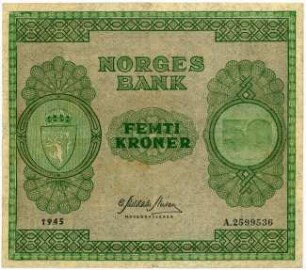

- (wer)

-

Norges Bank

- (wo)

-

Oslo

- (wann)

-

2013

- Handle

- Letzte Aktualisierung

- 10.03.2025, 11:44 MEZ

Datenpartner

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. Bei Fragen zum Objekt wenden Sie sich bitte an den Datenpartner.

Objekttyp

- Arbeitspapier

Beteiligte

- Gelain, Paolo

- Lansing, Kevin J.

- Norges Bank

Entstanden

- 2013