Arbeitspapier

The Bank of England as the World Gold Market-Maker During the Classical Gold Standard Era, 1889-1910

This paper studies the microfoundations of the so-called "gold device" policy by analysing a new dataset on the Bank of England's operations in the gold market at the heyday of the classical gold standard. It explains that "gold devices" must be understood in connection to the Bank's role as gold market-maker in London and to the position of London as world gold market. Contrary to the literature, the paper shows that "gold devices" were sophisticated monetary policy tools intended to complement - not to substitute - interest rate policy and aimed at smoothing - not at hampering - international adjustment. These findings demonstrate the potential of adopting a microstructural approach to the study of monetary policy, and call for a reassessment of efficiency measurement for the gold standard.

- ISBN

-

978-82-7553-703-2

- Language

-

Englisch

- Bibliographic citation

-

Series: Working Paper ; No. 2012/15

- Classification

-

Wirtschaft

Central Banks and Their Policies

Investment Banking; Venture Capital; Brokerage; Ratings and Ratings Agencies

Production, Pricing, and Market Structure; Size Distribution of Firms

Transactional Relationships; Contracts and Reputation; Networks

Economic History: Financial Markets and Institutions: Europe: Pre-1913

- Subject

-

monetary policy

gold standard

gold market

market microstructure

- Event

-

Geistige Schöpfung

- (who)

-

Ugolini, Stefano

- Event

-

Veröffentlichung

- (who)

-

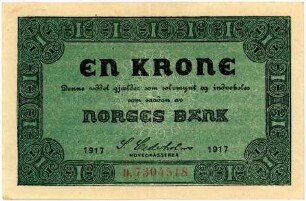

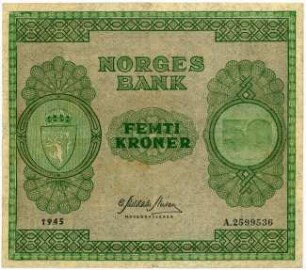

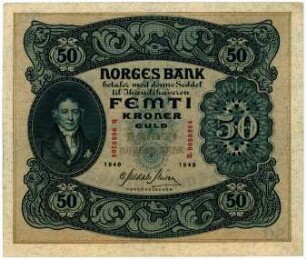

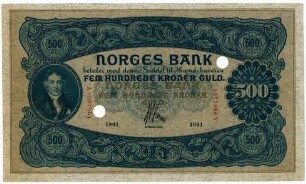

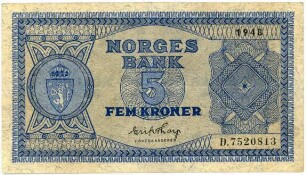

Norges Bank

- (where)

-

Oslo

- (when)

-

2012

- Handle

- Last update

- 10.03.2025, 11:42 AM CET

Data provider

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. If you have any questions about the object, please contact the data provider.

Object type

- Arbeitspapier

Associated

- Ugolini, Stefano

- Norges Bank

Time of origin

- 2012