Arbeitspapier

Taxing multinationals beyond borders: Financial and locational responses to CFC rules

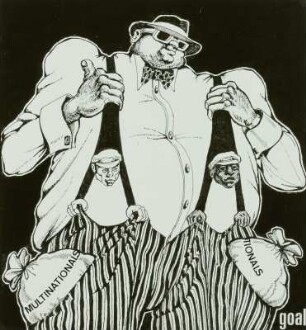

Using a large panel dataset on worldwide operations of multinational firms, this paper studies one of the most advocated anti-tax-avoidance measures: Controlled Foreign Corporation rules. By including income of foreign low-tax subsidiaries in the domestic tax base, these rules create incentives for multinationals to move income away from low-tax environments. Exploiting variation around the tax threshold used to identify low-tax subsidiaries, we find that multinationals redirect profits into subsidiaries just above the threshold and place more new subsidiaries just above compared to just below the threshold. The resulting increase in global corporate tax revenue partly accrues to the rule-enforcing country.

- Language

-

Englisch

- Bibliographic citation

-

Series: EPRU Working Paper Series ; No. 2017-02

- Classification

-

Wirtschaft

Multinational Firms; International Business

Business Taxes and Subsidies including sales and value-added (VAT)

Tax Law

- Subject

-

CFC legislation

Multinational firms

Tax avoidance

Corporate taxation

- Event

-

Geistige Schöpfung

- (who)

-

Clifford, Sarah

- Event

-

Veröffentlichung

- (who)

-

University of Copenhagen, Economic Policy Research Unit (EPRU)

- (where)

-

Copenhagen

- (when)

-

2017

- Handle

- Last update

-

10.03.2025, 11:43 AM CET

Data provider

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. If you have any questions about the object, please contact the data provider.

Object type

- Arbeitspapier

Associated

- Clifford, Sarah

- University of Copenhagen, Economic Policy Research Unit (EPRU)

Time of origin

- 2017